2024 Schedule D Form Instructions – the IRS writes in its Schedule D instructions. If your business sold a stock, bond or other investment asset, you will receive a 1099-B form with all of the information on the sale from each and . Doing the Schedule D Schedule D for capital gains can be Before diving in, study the 10-page Instructions for Form 4797, or hire an accountant well-versed in business tax law. .

2024 Schedule D Form Instructions

Source : kdvr.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

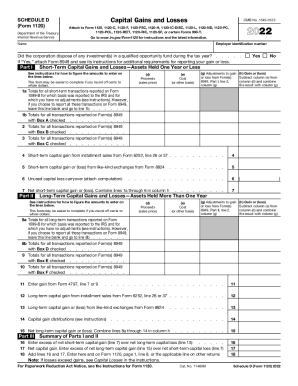

Source : finance.yahoo.comIRS 1040 Schedule D Instructions 2022 2024 Fill and Sign

Source : www.uslegalforms.com2023 Instructions for Schedule D

Source : www.irs.govThe Wall Street Journal on LinkedIn: What the 2024 Capital Gains

Source : www.linkedin.com2024 Tax Update and What to Expect

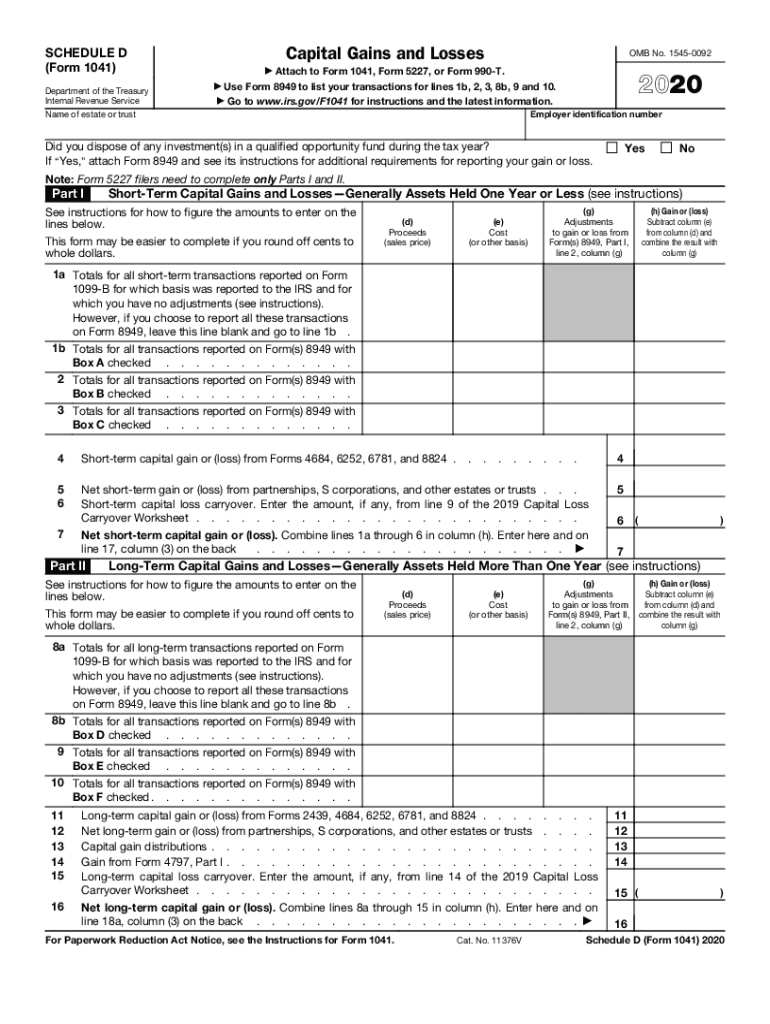

Source : sourceadvisors.comSchedule d tax form: Fill out & sign online | DocHub

Source : www.dochub.comSchedule D 2022 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comSchedule d: Fill out & sign online | DocHub

Source : www.dochub.comNorth Miami Public Library (@nomilibrary) • Instagram photos and

Source : www.instagram.com2024 Schedule D Form Instructions New IRS Schedule D Tax Form Instructions and Printable Forms for : (See instructions.) Yes or No. Digital representations of value to figure their capital gain or loss on the transaction and then report it on Schedule D (Form 1040), Capital Gains and Losses. A . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com .

]]>